Natural Gas Retail Cashouts Made Easy

Natural Gas customers, especially high-volume users, often demand flexibility in contract length, terms, and fixed price conversion when choosing a Natural Gas Supplier. While many customers may choose to secure the full requirements of their contract to reduce exposure to market and price volatility, it is common for others to choose to lock in either part or all the basis or transportation costs. These customers then have the option of fixing the price later when market conditions become more favorable.

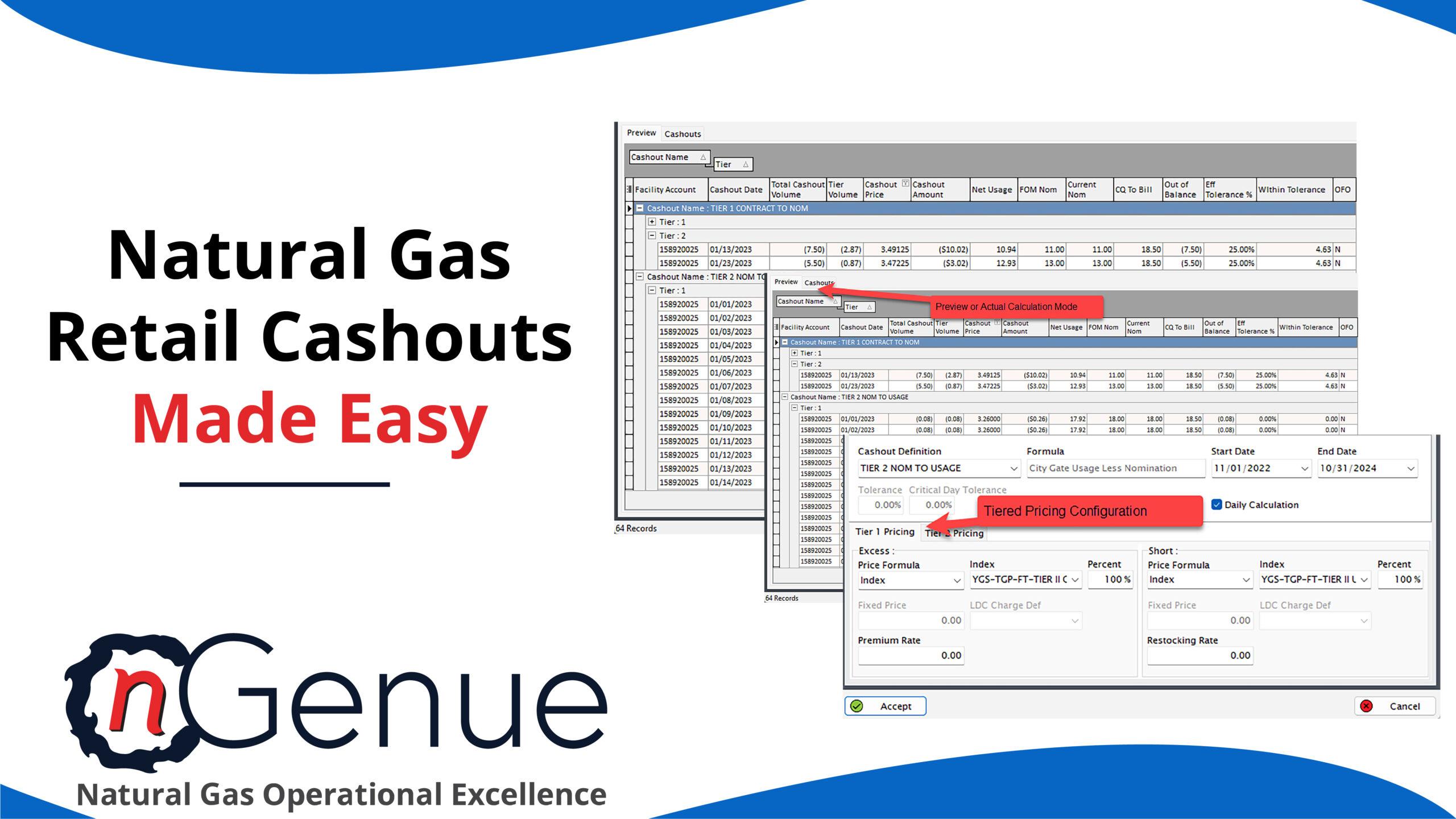

A monthly cashout makes sense for some natural gas customers while others need more complex daily cashout scenarios based on their meter interval type. For a monthly meter read, the average daily delivered quantity is compared to the average daily contract quantity to apply the cashout. For a daily read, the actual usage or gas delivery can be compared to the first of the month contract quantity using a FOM variance calculation method. To calculate these premium or remarket rates there may be a variety of cost components that need to be considered, factoring in locked in prices, pipeline fees, daily purchases, and sales or OFO premiums.

A cashout is first defined with a premium rate when there is excess gas needed and a restocking rate when usage is short. If a Swing product is offered, this threshold factor is added, to be accounted for prior to the long or short position. Daily or monthly balancing could also include the option to buy or sell daily as the Supplier decides, or the Supplier sales team may collaborate with customers with distinct daily demand. The impact of daily volume fluctuations and pipeline system conditions could pose a considerable risk to a customer or Supplier’s bill.

If you are a Natural Gas Supplier offering unique natural gas products with layers of complex pricing components for personalized service to your customers, you need software functionality that can accommodate each of these calculation scenarios to bill customers accurately month to month. Such specialized product configuration is available within nGenue’s Price Agreement Cashout functionality.

Whatever the required price calculation, nGenue’s Retail Cashout functionality enables building it out, providing Suppliers with the flexibility to calculate the right pricing product to offer their customers. While a full requirements customer may have a single price tier at one fixed price for the term of the contract, another customer may choose price certainty only for a portion of their contract quantity for a variety of periods ranging from months to years. Natural Gas Suppliers require the flexibility to lock in NYMEX or BASIS volumes multiple times for a single month, while also calculating associated fees.

Additional nGenue functionality works in conjunction with retail cashout functionality to enable the Supplier’s sales and operation teams to better serve individual customer requirements. These System Activity and Task alerts can provide automated notifications when there are Operational Flow Orders (OFO) and when it is important to act or reach out to those customers impacted.

LDCs, Marketers, Pipelines, Producers, and Utilities face increasing competitive and compliance pressures, requiring increased operational efficiency, data integrity and process improvement. Their operational systems must support this, but most don’t. Engage us and we’ll show you how to make a breakthrough. It’s what we do for natural gas companies, and we are experts in our field.

nGenue enables Natural Gas Operational Excellence!

~Ken